What is ETI?

Employment Tax Incentive (ETI) is one of the most powerful SME tax benefits there is.

The ETI reduces your (the employer’s) overall Pay-As-You-Earn (PAYE) contribution without affecting individual employee wages.

In his 2022 Budget Speech, Finance Minister Enoch Godongwana announced an increase in the ETI values from 1 March 2022.

An employee qualifies for the ETI if he/she:

- works for you, assists in conducting business, and receives remuneration for their work,

- is documented in your employer records according to the provisions of section 31 of the BCEA,

- earns at least the minimum wage,]

- is between 18 and 29 years old, or is employed in a special economic zone, and

- has a valid South African ID, a valid asylum seeker permit, or an ID in terms of Section 30 of the Refugees Act.

An employee will not qualify for the ETI if he/she:

- is a domestic worker,

- is a “connected person” to the employer,

- spends more time studying than working (unless the employer and employee have entered into a learning programme as defined in Section 1 of the Skills Development act, or

- earns a monthly remuneration of R6,500 or more.

How does the ETI work?

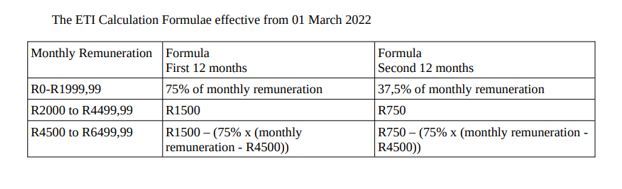

The ETI Calculation Formula effective from 1 March 2022:

Let’s say you hire five South African employees aged between 20 and 25 with salaries of R4,000 per month. The total monthly payroll for these five employees is R20,000. Thanks to the ETI, you can deduct the equivalent of R7,500 from your overall monthly PAYE liability in the first 12 months in which the employees qualify. You can deduct R3,750 in the second 12 months in which the employees qualify.

Your employees’ wages are completely unaffected.

The ETI is administered by the employer. In other words, your payroll system does the calculations and the employer must deduct the total ETI calculated by the payroll system for the month from the total PAYE payable to SARS. For cash-conscious SMEs, the ETI can provide a helpful return on employment that can be invested back into the business.

Keep your submissions simple this Tax Year-End

Get the latest expert advice and free resources to help you manage your payroll and enable compliance.

Find out more about Bookkeeping Services Payroll – Sage or Xero Payroll in the cloud.

The ETI small print

The ETI is a widely beneficial tax benefit: employers are rewarded for hiring young people, and young people gain valuable work skills and experience. As a result, the private sector grows, and the economy strengthens.

Employees can qualify for ETI for 24 months from employment with the employer/associated employer – these do not have to be consecutive months and only qualifying months are counted towards the 24 months. The incentive falls away after the 24 qualifying months and cannot be switched on retroactively, so make sure you apply the ETI as soon as you employ an eligible worker.

Do you qualify for the ETI?

Your company needs to pay PAYE through its more senior employees’ salaries to benefit from the ETI. The best way to determine if the ETI is a relevant tax advantage for your business is to conduct a financial health assessment.

For every new monthly accounting client one of the first things we look at is if they can use the ETI on the client’s payroll.

Small business owners have a lot on their plates, so it’s understandable that many want to comply with legislation and get on with business. That said, SMEs have nothing to lose and only lots to gain from the ETI, so it’s worth investigating further.

Please note: These are just guidelines and the facts may change. Please contact us to keep up to date.