Hemel & Aarde Village

c/o R43 & R320, Shop 3B, Hemel and Aarde Road, Hermanus, 7201

082 352 9006

Call Us

Mon - Fri: 9:00 - 16:00

Saturday: 9:00 - 13:00

c/o R43 & R320, Shop 3B, Hemel and Aarde Road, Hermanus, 7201

Call Us

Saturday: 9:00 - 13:00

In order to use SARS eFiling, you will need your own tax reference number.

If you do not have one, please see how to get a South African tax number.

One of SARS initiatives is that new taxpayers can now apply for a tax number via eFiling.

We’ve created a step by step guide for you to follow, once you log into your eFiling account you’ll see your new tax reference number on your top left-hand side.

Step 1:

Please log on to the SARS website (https://www.sarsefiling.co.za). On the middle right side of the home page is a list of options where you need to select Register Now

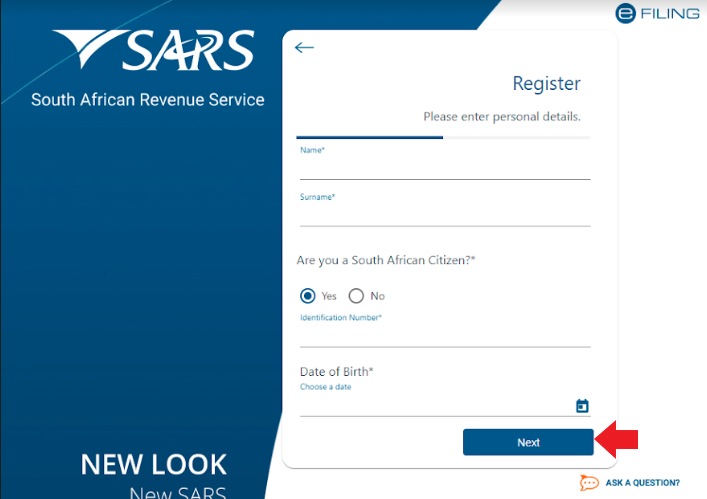

Step 2:

The eFiling Register screen will appear where you need to complete your personal details, then click next

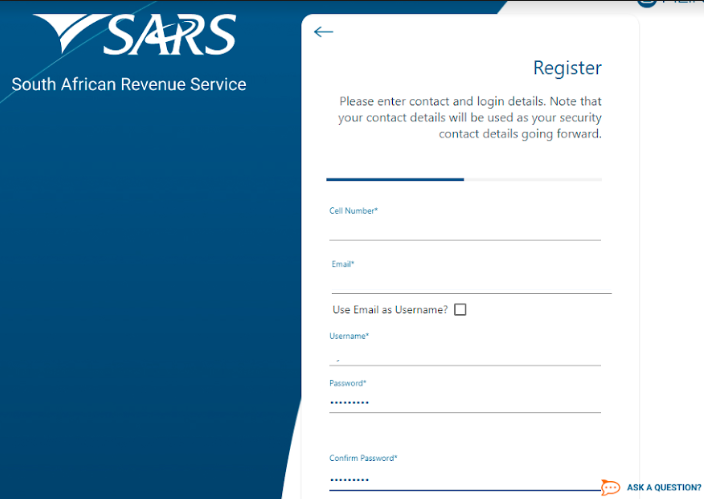

Step 3:

Complete your contact details along with login details that you would like to use, then click next

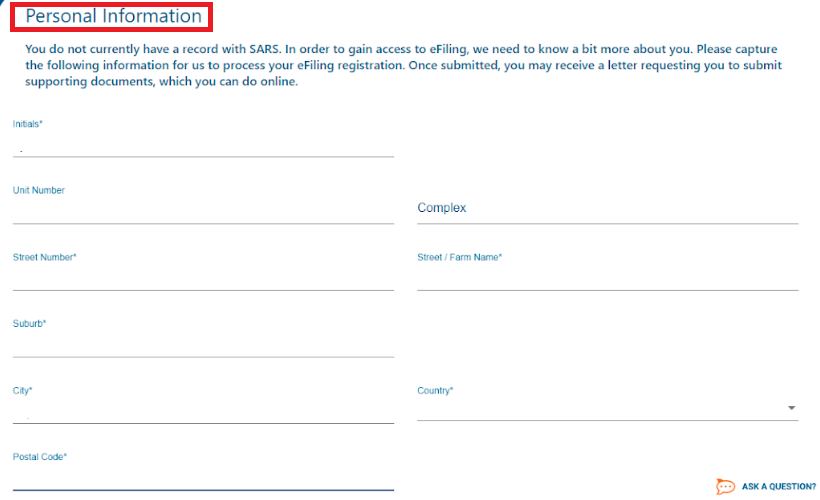

Step 4:

Complete all your additional personal details in order for SARS to register you for a tax number and on efiling.

Step 5:

Select the preferred method of communication between you and SARS. The method you select will serve as your eFiling security contact details and will be used to send a One-Time-Pin (OTP) to authenticate you.

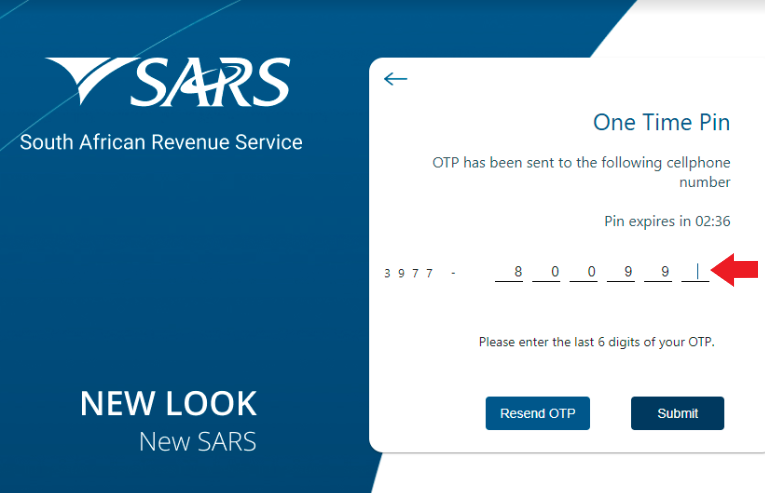

Step 6:

Enter the correct OTP pin number send to you by sms or email address.

Step 7:

Once you are done the eFiling Login screen will appear meaning your registration was successful.

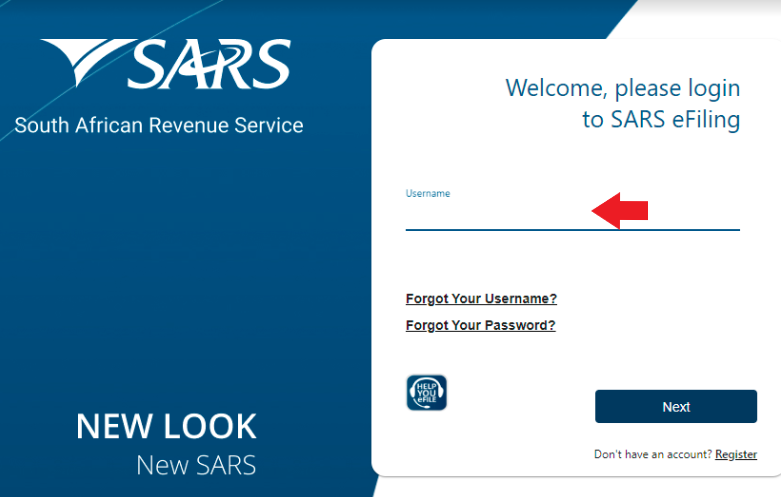

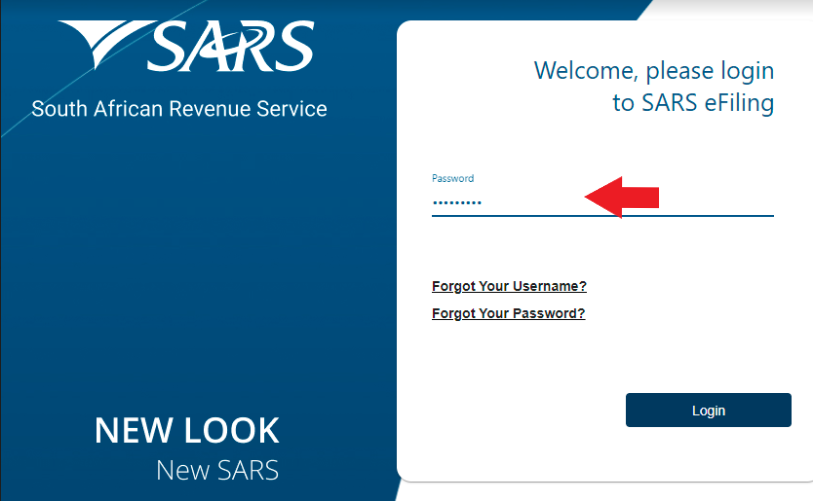

Step 8:

You will now need to log on to the SARS efiling website by using the Username and Password details you entered when completing the registration process on the top right side of the home page, click Next

Step 9:

The eFiling welcome screen will display the terms and conditions, please read and select the “I Accept” at the bottom of the screen to continue with the log in process.

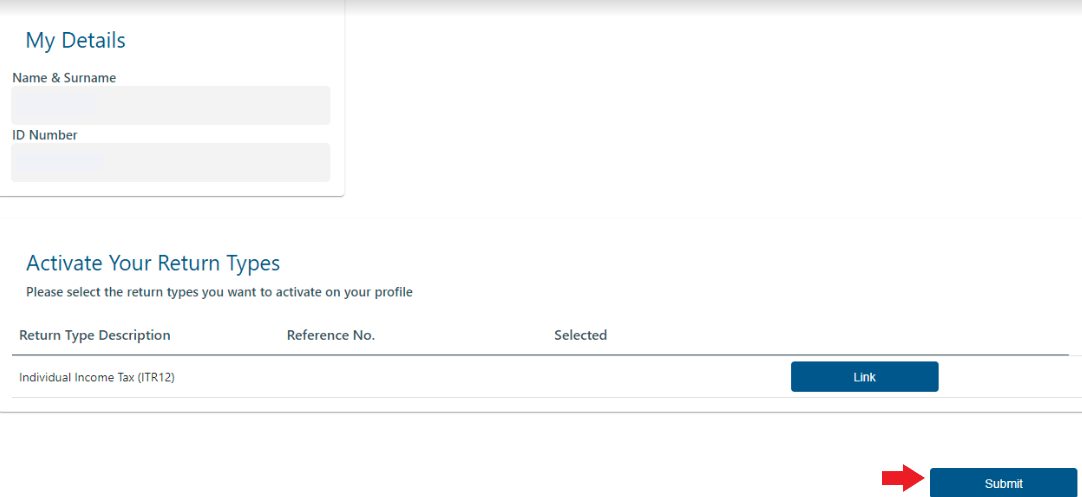

Step 10:

The screen will show your details as entered by you. After you have selected the return type(s), click on “Submit” to activate your SARS efiling profile.

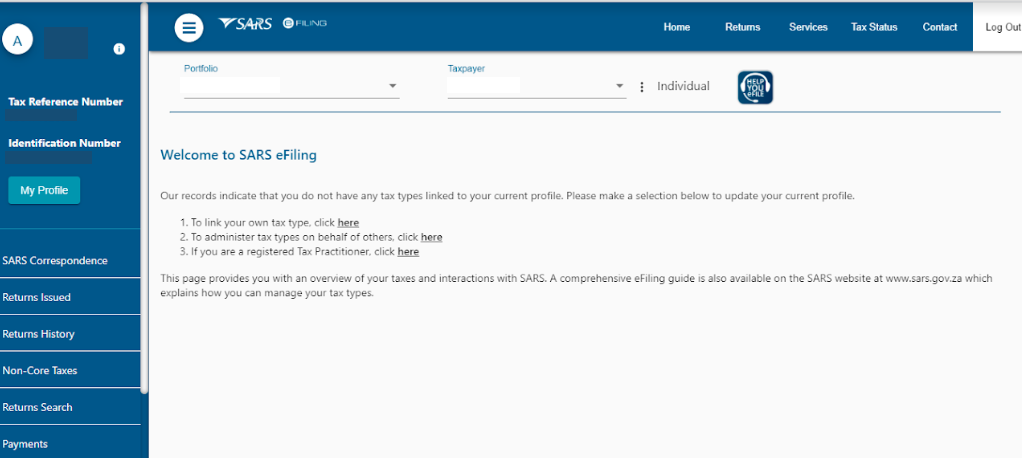

Step 11:

You will then reach the eFiling home page where the display provides a visual summary of your current tax affairs. From here you can request a statement of account or any notices sent by SARS to see if you are up to date will all your tax returns.

Bookkeeping Services Overberg we will help you through the next steps of becoming tax compliant. We offer remote services & can assist you anywhere in South Africa.